RSI and Random Forest

04 Nov 2014To install Systematic Investor Toolbox (SIT) please visit About page.

Tad Slaff at InovanceTech published How to Trade the RSI: An analysis using a Support Vector Machine post that I like. Below I will explore it a bit more.

Load Historical Prices. Let’s start with AUD/USD 4 hour bar pricesdropbox.

#*****************************************************************

# Load historical data

#******************************************************************

library(SIT)

load.packages('quantmod')

data <- new.env()

data$AUDUSD = read.xts('data/AUDUSD.csv', format='%m/%d/%y %H:%M', index.class = c("POSIXlt", "POSIXt"))

#plota(data$AUDUSD, type='l')

bt.prep(data, align='remove.na')Create Indicators and Train SVM:

# helper functions

make.predictor <- function(x) { iif(x > 0, 1, -1) }

#*****************************************************************

# Code Strategies

#******************************************************************

load.packages('e1071,ggplot2')

indicators = as.xts(list(

RSI3 = RSI(Cl(data$AUDUSD), 3),

DEMA10 = DEMA(Cl(data$AUDUSD), 10),

CCI2 = CCI(HLC(data$AUDUSD), 20)

))

SMA50 = SMA(Op(data$AUDUSD), 50)

DataSet = as.xts(list(

RSI3 = RSI(Op(data$AUDUSD), 3),

Trend = Op(data$AUDUSD) - SMA50,

Direction = make.predictor(Cl(data$AUDUSD) - Op(data$AUDUSD))

))

# remove NA's

DataSet = DataSet[-(1:49),]

#Separate the data into 60% training set to build our model, 20% test set to

# test the patterns we found, and 20% validation set to run our strategy over new

Training = DataSet[1:4528,]

Test = DataSet[4529:6038,]

Val = DataSet[6039:7548,]

#Build our support vector machine using a radial basis function as our kernel, the cost, or C, at 1, and the gamma function at , or 1 over the number of inputs we are using

SVM = svm(Direction ~ RSI3 + Trend, data=Training, kernel="radial",cost=1,gamma=1/2)

#Run the algorithm once more over the training set to visualize the patterns it found

TrainingPredictions = predict(SVM,Training,type="class")

TrainingPredictions = make.predictor(TrainingPredictions)

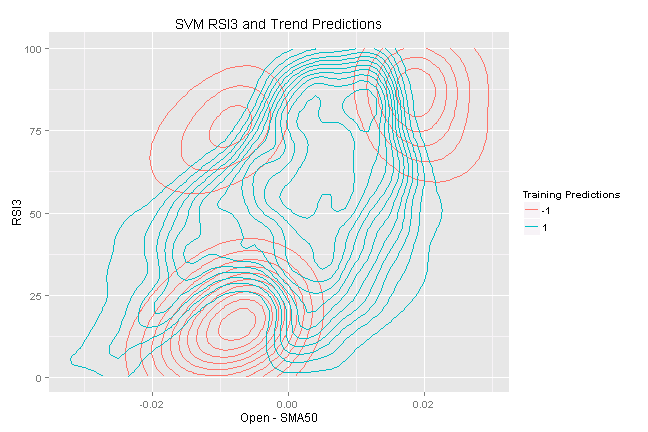

# Plot

TrainingData = data.frame(Training,TrainingPredictions)

ggplot(TrainingData, aes(x=Trend,y=RSI3)) +

stat_density2d(geom="contour",aes(color=as.factor(TrainingPredictions)))+

labs(title="SVM RSI3 and Trend Predictions",

x="Open - SMA50",y="RSI3",color="Training Predictions")

Now that we have found a basic set of rules that the SVM uncovered, lets test to see how well they hold up over new data, our test set.

# Now that we have found a basic set of rules that the SVM uncovered,

# lets test to see how well they hold up over new data, our test set.

ShortRange1 = Test$RSI3 < 25 & Test$Trend > -.010 & Test$Trend < -.005

ShortRange2 = Test$RSI3 > 70 & Test$Trend < -.005

ShortRange3 = Test$RSI3 > 75 & Test$Trend > .015

LongRange1 = Test$RSI3 < 25 & Test$Trend < -.02

LongRange2 = Test$RSI3 > 50 & Test$RSI3 < 75 & Test$Trend > .005 & Test$Trend < .01

# Now lets see how well these patterns hold up over out test set:

ShortTrades = Test[ShortRange1 | ShortRange2 | ShortRange3,]

ShortCorrect = sum(ShortTrades$Direction == -1)/nrow(ShortTrades)*100

ShortCorrect[1] 57.82313

LongTrades = Test[LongRange1 | LongRange2, ]

LongCorrect = sum(LongTrades$Direction == 1)/nrow(LongTrades)*100

LongCorrect[1] 57.14286

Wow! 58% (85 correct out of 147 trades) for our short trades and 57% (80 correct out of 140 trades) for our long trades.

Now lets turn this into an actual trading strategy with a stop loss and take profit as our exit conditions.

(this report was produced on: 2014-12-07)