Quantitative Approach To Tactical Asset Allocation Strategy

To install Systematic Investor Toolbox (SIT) please visit About page.

The Quantitative Approach To Tactical Asset Allocation Strategy(QATAA) by Mebane T. Faber backtest and live signal. For more details please see SSRN paper

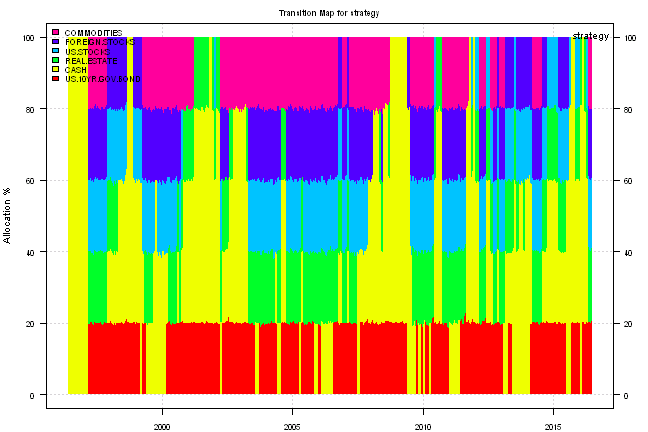

The QATAA Strategy allocates 20% across 5 asset classes:

- US Stocks

- Foreign Stocks

- US 10YR Government Bonds

- Real Estate

- Commodities

If asset is above it’s 10 month moving average it gets 20% allocation; otherwise, it’s weight is allocated to cash. The re-balancing process is done Monthly.

Following report is based on Monthly re-balancing, signal is generated one day before the month end, and execution is done at close at the month end.

Load historical data from Yahoo Finance:

#*****************************************************************

# Load historical data

#*****************************************************************

library(SIT)

load.packages('quantmod')

tickers = '

US.STOCKS = VTI + VTSMX

FOREIGN.STOCKS = VEU + FDIVX

US.10YR.GOV.BOND = IEF + VFITX

REAL.ESTATE = VNQ + VGSIX

COMMODITIES = DBC + CRB

CASH = BND + VBMFX

'

# load saved Proxies Raw Data, data.proxy.raw

load('data.proxy.raw.Rdata')

data <- new.env()

getSymbols.extra(tickers, src = 'yahoo', from = '1970-01-01', env = data, raw.data = data.proxy.raw, auto.assign = T, set.symbolnames = T, getSymbols.fn = getSymbols.fn, calendar=calendar)

for(i in data$symbolnames) data[[i]] = adjustOHLC(data[[i]], use.Adjusted=T)

bt.prep(data, align='remove.na', dates='::')

print(last(data$prices))| US.STOCKS | FOREIGN.STOCKS | US.10YR.GOV.BOND | REAL.ESTATE | COMMODITIES | CASH | |

|---|---|---|---|---|---|---|

| 2016-06-24 | 104.05 | 41.22 | 112.21 | 84.86 | 15.01 | 83.7 |

#*****************************************************************

# Setup

#*****************************************************************

data$universe = data$prices > 0

# do not allocate to CASH

data$universe$CASH = NA

prices = data$prices * data$universe

n = ncol(prices)Code Strategy Rules:

#*****************************************************************

# Code Strategy

#******************************************************************

sma = bt.apply.matrix(prices, SMA, 200)

# If asset is above it's 10 month moving average it gets 20% allocation

weight = iif(prices > sma, 20/100, 0)

# otherwise, it's weight is allocated to cash

weight$CASH = 1 - rowSums(weight)

obj$weights$strategy = weight[period.ends,]

#Strategy Performance:

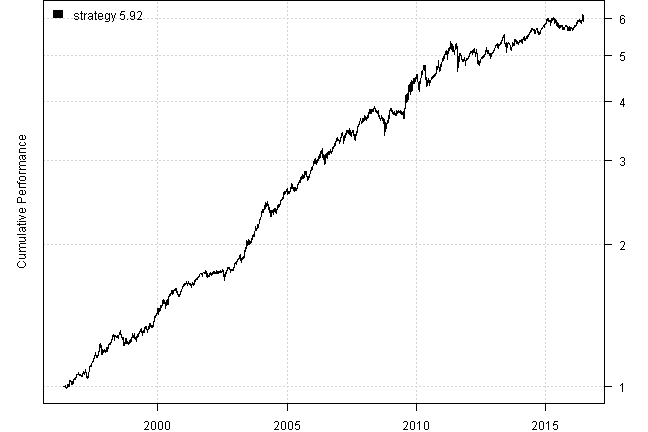

| strategy | |

|---|---|

| Period | May1996 - Jun2016 |

| Cagr | 9.23 |

| Sharpe | 1.14 |

| DVR | 1.12 |

| R2 | 0.98 |

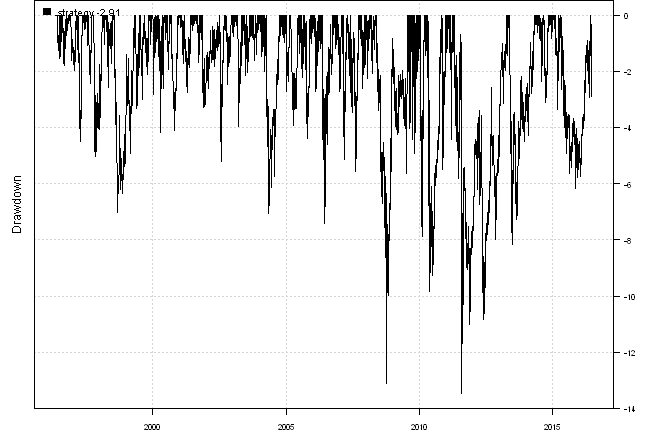

| Volatility | 8.02 |

| MaxDD | -13.48 |

| Exposure | 99.72 |

| Win.Percent | 64.15 |

| Avg.Trade | 0.2 |

| Profit.Factor | 2.04 |

| Num.Trades | 993 |

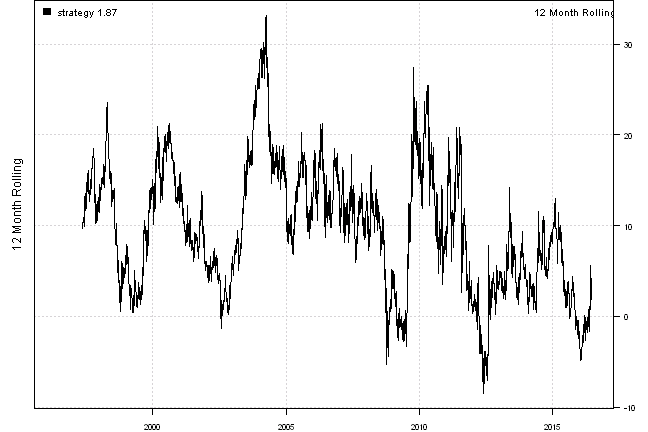

#Monthly Results for strategy :

| Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec | Year | MaxDD | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 1996 | 1.3 | 0.2 | -0.2 | 1.7 | 2.2 | 1.7 | -0.9 | 6.2 | -1.8 | |||||

| 1997 | 0.2 | 0.0 | -0.6 | 0.9 | 4.0 | 2.2 | 3.8 | -2.2 | 5.0 | -1.8 | -0.2 | 1.5 | 13.3 | -5.0 |

| 1998 | 1.0 | 2.0 | 2.5 | 0.3 | 0.0 | 1.1 | -0.1 | -4.7 | 2.3 | -0.6 | 0.3 | 2.1 | 6.0 | -7.0 |

| 1999 | 1.4 | -2.7 | 1.9 | 2.5 | -1.9 | 3.1 | -0.6 | 1.0 | 1.2 | 0.3 | 3.2 | 4.7 | 14.8 | -3.6 |

| 2000 | -1.2 | 3.1 | 1.8 | -1.3 | 0.9 | 3.4 | 0.3 | 2.1 | -1.2 | -1.2 | 2.4 | 2.2 | 11.9 | -4.2 |

| 2001 | 1.1 | 0.1 | -0.6 | -0.1 | 0.9 | 1.5 | 1.4 | 1.6 | 0.2 | 0.8 | -1.6 | -0.2 | 5.3 | -3.3 |

| 2002 | 0.1 | 1.1 | -0.2 | -0.1 | 0.8 | 0.8 | -2.5 | 2.1 | 1.3 | -0.8 | -0.4 | 3.3 | 5.7 | -5.2 |

| 2003 | 1.5 | 2.3 | -1.8 | 0.7 | 5.3 | 1.2 | 1.1 | 2.3 | 1.3 | 2.9 | 1.7 | 4.4 | 25.5 | -4.0 |

| 2004 | 2.4 | 3.1 | 1.7 | -5.1 | 1.0 | 0.3 | -0.4 | 2.8 | 1.3 | 2.5 | 2.6 | 1.8 | 14.4 | -7.1 |

| 2005 | -2.0 | 3.0 | -0.5 | -0.7 | 1.1 | 2.1 | 3.4 | 1.2 | 1.0 | -3.0 | 2.4 | 2.4 | 10.6 | -4.4 |

| 2006 | 4.4 | -0.9 | 2.5 | 1.7 | -2.3 | 0.7 | 1.5 | 1.3 | 0.2 | 2.8 | 2.5 | -0.4 | 14.8 | -7.4 |

| 2007 | 1.7 | -0.4 | 0.5 | 1.8 | 1.0 | -2.0 | -0.2 | 0.6 | 4.0 | 3.7 | -0.9 | 1.2 | 11.2 | -5.6 |

| 2008 | 0.2 | 2.5 | 0.3 | 0.5 | 0.5 | -1.5 | -1.8 | -0.5 | -2.4 | -2.6 | 4.7 | 5.1 | 4.7 | -13.1 |

| 2009 | -2.5 | -0.6 | 1.5 | -0.2 | 0.1 | 0.0 | 4.5 | 3.5 | 3.4 | -0.8 | 4.5 | 1.4 | 15.6 | -4.9 |

| 2010 | -4.3 | 2.9 | 4.3 | 2.4 | -6.3 | -1.1 | 2.6 | 1.3 | 0.8 | 3.3 | -1.4 | 5.2 | 9.4 | -9.8 |

| 2011 | 1.9 | 3.1 | 0.2 | 4.0 | -1.4 | -2.2 | 0.9 | -3.3 | -2.1 | -0.2 | -0.8 | 1.3 | 0.9 | -13.5 |

| 2012 | 2.7 | 0.3 | 0.8 | 0.3 | -6.2 | 1.8 | 1.3 | 1.6 | 0.6 | -1.3 | 0.6 | 1.5 | 3.8 | -7.7 |

| 2013 | 2.5 | -0.7 | 1.5 | 2.9 | -2.4 | -2.1 | 1.5 | -2.8 | 2.9 | 2.0 | -0.6 | 0.4 | 4.9 | -8.2 |

| 2014 | -0.9 | 2.3 | 0.1 | 1.3 | 1.3 | 1.4 | -1.7 | 2.2 | -3.0 | 3.1 | 1.4 | 0.4 | 8.0 | -3.1 |

| 2015 | 2.6 | -0.7 | 0.1 | -0.3 | -0.2 | -2.4 | 0.8 | -1.4 | 0.8 | -0.2 | -0.3 | -0.3 | -1.7 | -6.2 |

| 2016 | 0.2 | 0.9 | 2.4 | -0.4 | 0.7 | -0.4 | 3.6 | -2.9 | ||||||

| Avg | 0.7 | 1.0 | 0.9 | 0.6 | -0.2 | 0.4 | 0.8 | 0.4 | 1.0 | 0.6 | 1.1 | 1.9 | 9.0 | -6.1 |

#Trades for strategy :

| strategy | weight | entry.date | exit.date | nhold | entry.price | exit.price | return |

|---|---|---|---|---|---|---|---|

| CASH | 80 | 2015-12-31 | 2016-01-29 | 29 | 80.43 | 81.39 | 0.96 |

| US.10YR.GOV.BOND | 20 | 2016-01-29 | 2016-02-29 | 31 | 108.31 | 109.92 | 0.3 |

| CASH | 80 | 2016-01-29 | 2016-02-29 | 31 | 81.39 | 82.09 | 0.68 |

| US.10YR.GOV.BOND | 20 | 2016-02-29 | 2016-03-31 | 31 | 109.92 | 109.85 | -0.01 |

| REAL.ESTATE | 20 | 2016-02-29 | 2016-03-31 | 31 | 75.19 | 83.05 | 2.09 |

| CASH | 60 | 2016-02-29 | 2016-03-31 | 31 | 82.09 | 82.65 | 0.41 |

| US.STOCKS | 20 | 2016-03-31 | 2016-04-29 | 29 | 104.82 | 105.51 | 0.13 |

| US.10YR.GOV.BOND | 20 | 2016-03-31 | 2016-04-29 | 29 | 109.85 | 109.68 | -0.03 |

| REAL.ESTATE | 20 | 2016-03-31 | 2016-04-29 | 29 | 83.05 | 81.1 | -0.47 |

| CASH | 40 | 2016-03-31 | 2016-04-29 | 29 | 82.65 | 82.81 | 0.08 |

| US.STOCKS | 20 | 2016-04-29 | 2016-05-31 | 32 | 105.51 | 107.34 | 0.35 |

| FOREIGN.STOCKS | 20 | 2016-04-29 | 2016-05-31 | 32 | 44.06 | 43.71 | -0.16 |

| US.10YR.GOV.BOND | 20 | 2016-04-29 | 2016-05-31 | 32 | 109.68 | 109.57 | -0.02 |

| REAL.ESTATE | 20 | 2016-04-29 | 2016-05-31 | 32 | 81.1 | 82.92 | 0.45 |

| COMMODITIES | 20 | 2016-04-29 | 2016-05-31 | 32 | 14.58 | 14.71 | 0.18 |

| US.STOCKS | 20 | 2016-05-31 | 2016-06-24 | 24 | 107.34 | 104.05 | -0.61 |

| FOREIGN.STOCKS | 20 | 2016-05-31 | 2016-06-24 | 24 | 43.71 | 41.22 | -1.14 |

| US.10YR.GOV.BOND | 20 | 2016-05-31 | 2016-06-24 | 24 | 109.57 | 112.21 | 0.48 |

| REAL.ESTATE | 20 | 2016-05-31 | 2016-06-24 | 24 | 82.92 | 84.86 | 0.47 |

| COMMODITIES | 20 | 2016-05-31 | 2016-06-24 | 24 | 14.71 | 15.01 | 0.41 |

#Signals for strategy :

| US.STOCKS | FOREIGN.STOCKS | US.10YR.GOV.BOND | REAL.ESTATE | COMMODITIES | CASH | |

|---|---|---|---|---|---|---|

| 2014-10-30 | 20 | 0 | 20 | 20 | 0 | 40 |

| 2014-11-26 | 20 | 0 | 20 | 20 | 0 | 40 |

| 2014-12-30 | 20 | 0 | 20 | 20 | 0 | 40 |

| 2015-01-29 | 20 | 0 | 20 | 20 | 0 | 40 |

| 2015-02-26 | 20 | 20 | 20 | 20 | 0 | 20 |

| 2015-03-30 | 20 | 20 | 20 | 20 | 0 | 20 |

| 2015-04-29 | 20 | 20 | 20 | 20 | 0 | 20 |

| 2015-05-28 | 20 | 20 | 20 | 20 | 0 | 20 |

| 2015-06-29 | 20 | 20 | 0 | 0 | 0 | 60 |

| 2015-07-30 | 20 | 0 | 0 | 0 | 0 | 80 |

| 2015-08-28 | 0 | 0 | 20 | 0 | 0 | 80 |

| 2015-09-29 | 0 | 0 | 20 | 0 | 0 | 80 |

| 2015-10-29 | 20 | 0 | 20 | 20 | 0 | 40 |

| 2015-11-27 | 20 | 0 | 20 | 20 | 0 | 40 |

| 2015-12-30 | 0 | 0 | 0 | 20 | 0 | 80 |

| 2016-01-28 | 0 | 0 | 20 | 0 | 0 | 80 |

| 2016-02-26 | 0 | 0 | 20 | 20 | 0 | 60 |

| 2016-03-30 | 20 | 0 | 20 | 20 | 0 | 40 |

| 2016-04-28 | 20 | 20 | 20 | 20 | 20 | 0 |

| 2016-05-27 | 20 | 20 | 20 | 20 | 20 | 0 |

For your convenience, the Strategy-TAA report can also be downloaded and viewed the pdf format.

(this report was produced on: 2016-06-25)